Travel medical insurance is an effective way to protect yourself in the event of a health emergency, whether you need treatment at your destination or you must be medically evacuated to receive medically-necessary care. Travel medical insurance also typically covers trip interruptions, travel delays, and/or lost luggage.

But did you know that a travel medical policy can also offer some unexpected benefits? From pet return to emergency dental—and even terrorism coverage—this international insurance is a great way to cover an emergency issue that may arise while you are away from home.

Here are 12 areas of travel medical coverage that might surprise you:

1. Deductibles

Most policies allow you to choose the deductible that's best for your budget—in general, the lower the deductible, the higher the premium.

With Atlas Travel insurance, deductibles start at $0 and range up to $2,500 per certificate period.

2. Pet Return

The cost of sending your favorite furry friend back to your home country if you become unexpectedly hospitalized is included in an Atlas policy, for up to $1,000 per certificate period. This covers one-way economy air or ground transportation to "the terminal serving the principle residence."

The policy includes a provision that you must be hospitalized for an illness or injury that will lead to the pet being "unattended" for more than 36 hours.

3. Emergency Dental

Don't worry about a toothache wreaking havoc on your travels. Emergency dental work (to address "acute onset of pain") is covered by Atlas Travel for $250 per certificate period.

4. Bedside Visit

If you are "confined" to a hospital intensive care unit for treatment of a "life-threatening" bodily injury or illness, Atlas has you covered. The policy will pay up to $1,500 per certificate period for round-trip economy air or ground transportation for a relative to visit you at your bedside.

5. Emergency Reunion

Should you need to be evacuated for an emergency medical condition, Atlas authorizes up to $50,000 per certificate period. This lasts for a maximum of 15 days and pays for a relative's round-trip air or ground transportation, as well as his or her lodging and meals.

6. Return of Minor Children

If you are hospitalized for a covered injury or illness and expected to remain in the hospital for 36+ hours, an Atlas policy can ensure your dependent children under 18 are safely transported back to "the terminal serving the principle residence."

The policy provides up to $50,000 per certificate period towards the cost of their one-way economy air or ground transportation.

7. Crisis Response

In the event of an express kidnapping, you can receive up to $10,000 per certificate period for ransom, personal belongings surrendered, and/or "Crisis Response fees and expenses." The benefit also provides 24/7 access to our Response Operations Center, which is staffed with expert crisis consultants and negotiators.

If you purchase an Atlas Premium policy, your Crisis Response coverage maximum jumps to $100,000.

8. Terrorism

You can also receive up to $50,000 over the course of your lifetime for the treatment of injuries and illnesses stemming from an act of terrorism, under certain circumstances.

This benefit does not offer coverage in countries where a U.S. State Department travel warning has been issued, but it is valuable in other countries where there is a chance of an occurrence but no general reason to expect one.

Learn more about terrorism coverage here.

9. Natural Disaster

What happens if there's an earthquake, floor, hurricane, tsunami, or other natural disaster while you're traveling abroad?

If you cannot stay in your hotel or other paid accommodations due to an evacuation from a "forecasted disaster" or "disaster strike," you may qualify for $100 a day in coverage for up to five days in order to secure replacement accommodations.

With an Atlas Premium policy, this per-day benefit increases to $250 for up to 5 days.

10. Personal Liability

You may receive up to $10,000 (Atlas Travel) or $100,000 (Atlas Premium) in personal liability coverage if you become legally liable for paying damages that result from:

- Accidental death, illness or bodily injury to a third person

- Loss or damage to a third person's "material property"

- Loss or damage to the property of a "related third person"

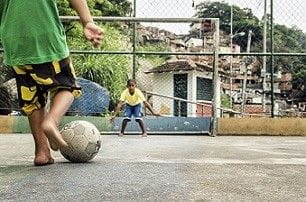

11. Sports and Activities

Note that these acts must not be committed intentionally or under the influence of drugs or alcohol in order for the benefit to apply.

Travel medical policies typically offer coverage for injuries resulting from amateur/non-professional sports and activities undertaken for leisure, recreational, or fitness purposes.

These policies typically do not pay for claims arising from:

- Organized athletics involving regular practice and/or games

- Activities performed in a professional capacity or for any wage, reward, or profit

- Sports and activities listed in its General Exclusions

It's important to read your Description of Coverage carefully to understand what sports and activities are excluded from coverage. For example, with an Atlas Travel policy, you will not be covered for injuries resulting from activities like parasailing, spelunking, and whitewater rafting.

To see the entire list of exclusions, visit the "Sports and Activities" page of Atlas Travel's Description of Coverage.

12. Repatriation of Remains or Local Burial or Cremation

If you were to pass away from a covered illness or injury, Atlas would cover the air or ground costs of transporting your remains to the airport nearest your home.

Or you may opt to be buried or cremated in the country of death, in which case your beneficiary would receive a benefit of $5,000 (lifetime maximum) to cover the cost.